Dec 03, 2020

In March, 2019 Apple released their “Apple Card”, a credit card with a truly Apple experience. Apple has been in the electronic payments business for a while now, first by letting you store credit cards securely on your devices in the Wallet app to use via Apple Pay and then with Apple Cash, a PayPal/Venmo type service for sending cash between people. The introduction of the Apple Card was a natural progression for Apple but, unlike other companies who have their own credit cards, this is not just an Apple-branded Master card, it’s an entire experience from start to finish.

First a quick disclaimer: If you don’t need a credit card you should just stop here and go check out videos of hamsters on YouTube. Credit cards can be a useful financial tool, but they can also be a terrible trap. Never ever use a credit card to buy something you can’t actually pay for. Treat credit cards as a convenience when paying and not as a line of credit and you’ll avoid a whole host of trouble. There are appropriate times to carry a balance on a credit card, but they are few and far between. If you think you should carry a balance you’re most likely wrong, so just avoid it and spare yourself the incredible expense and pain. Now that we have that out of the way…

The signup experience for the Apple Card is without a doubt the easiest of any credit card I have seen. You start from the Wallet app in your iPhone and everything just works. It’s a truly hassle free experience. I have a credit freeze with all of the major credit bureaus (and you probably should too), which means signing up for a new line of credit is deliberately difficult to do. I’ve tried signing up for things in the past with a credit freeze and it’s usually not clear what’s going on. When you finally remember that, oh yeah, I have a credit freeze, you usually have no clue to which credit bureau you should go to unfreeze. In my experience customer support reps are usually either unwilling or unable to tell you which bureau it might be, too. This wasn’t the case with the Apple Card; the app let me know right away that it couldn’t proceed because of a credit freeze and exactly which bureau they were using. In the grand scheme of things this is not a huge feature by any stretch, but it is a testament to the amount of care Apple has put into the setup experience.

At the tail end of setup you have the ability to order a physical card. The card is a huge piece of titanium, and it is a truly gorgeous credit card, at least as gorgeous as a credit card can be. If you go through the process of signing up for the Apple Card you should get one of the physical cards for the eye candy alone. When it did arrive the unboxing was impressive. Yes, unboxing. It wasn’t sent glued to a letter in an overstuffed envelope. Activating the physical card involved holding the card close to my iPhone. It was just that easy.

Now Apple is hoping you won’t actually use the physical card because they want you to use Apple Pay. It’s really wild how far Apple Pay has come over the past couple of years. What seemed novel when it was released is now nearly ubiquitous. As the pandemic has raged and contactless payments have become the norm, Apple Pay has really shined.

After a year and a half why did I finally try the Apple Card? Apple offers 3% back on purchases at Apple, and with the imminent release of the iPhone, and the prospect of buying a HomePod Mini it seemed like that might make it worth trying. My wife also got a new iPhone and it made sense to set her up with an Apple Card for the same purpose. Initially I expected she could be added to the card I setup, because that’s how every other credit card I’ve ever used works, however Apple Card doesn’t work that way. One Apple Card is for one individual and so we had to setup a separate card for my wife. We probably could have entered my card manually as a payment method on her Apple account for checking out, but when you’re trying to buy a new iPhone on launch day you want the checkout experience with the least amount of friction. I also don’t think she would have been able to add my card to Apple Pay on her phone in the same way, though I admit I didn’t actually try this out.

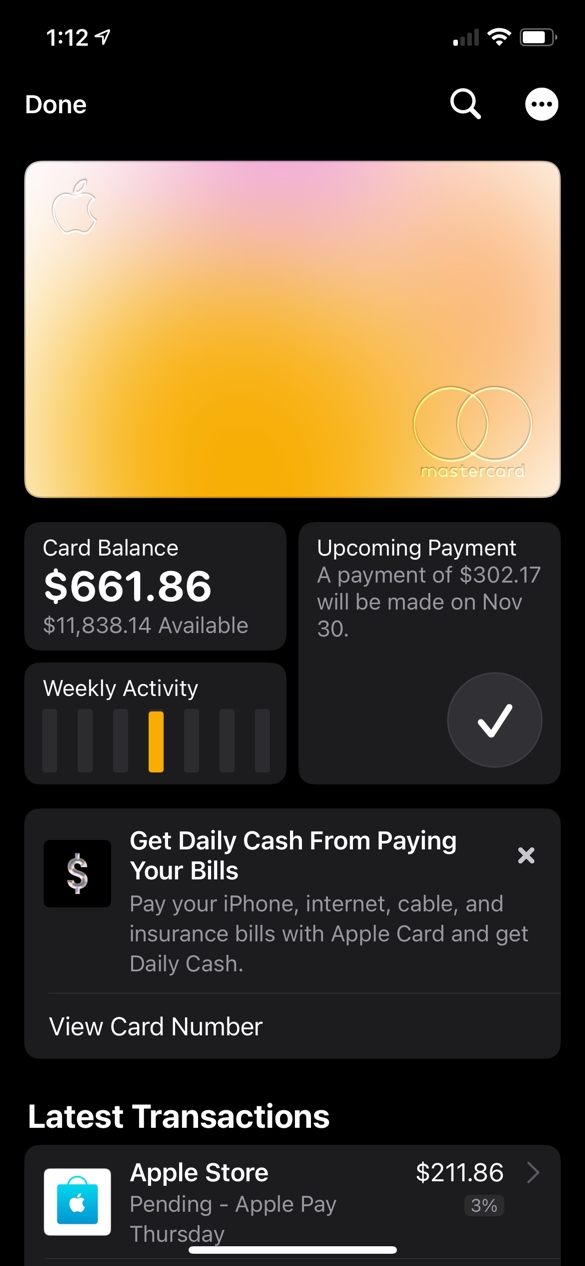

Separate cards are not inherently bad, and I suspect that for a lot of couples this is probably desirable. In our situation it’s a hassle. My wife and I have joint accounts on every front other than this one, and I handle the household finances month to month. My first concern was making sure the card was paid on time, because all of that happens in the Wallet app. It turns out it’s pretty easy to setup automatic payment, which is keyed wonderfully to the final day of the month. This alleviated my fears of potentially missing a payment, but it still lacked the visibility I wanted in how the card was being used. There’s also no easy way for me to see what the balance of her card is without her iPhone, but more on that later.

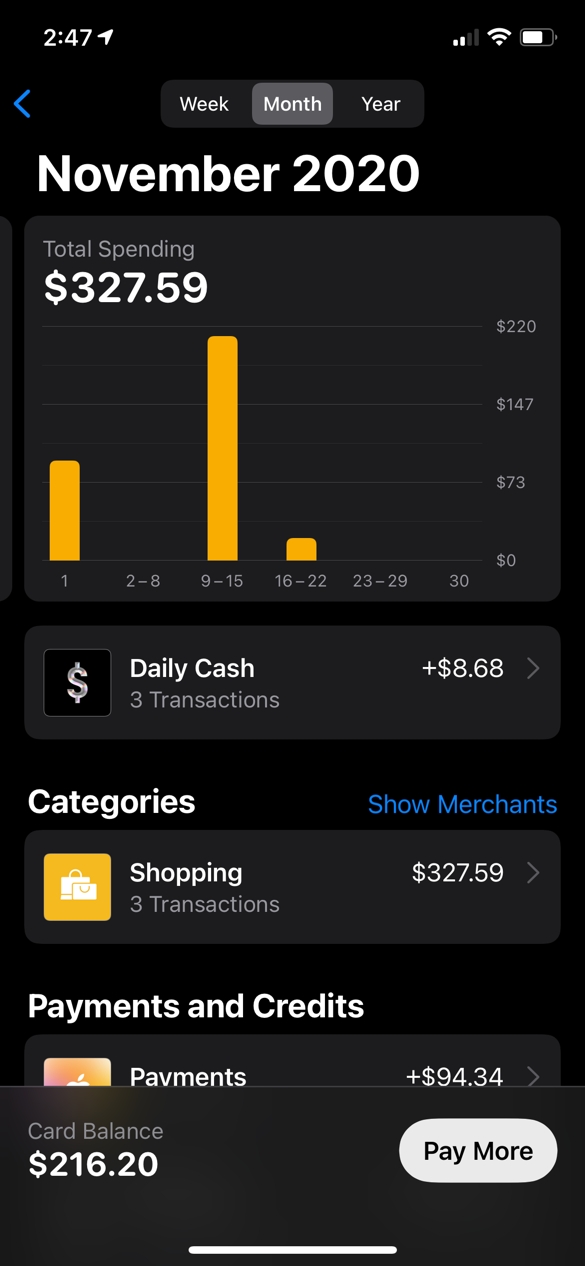

One of the coolest features of the Apple Card is the visuals around transactions. Apple Card categorizes them automatically for you and has great little graphs for how much you’ve spent over the month. The thing about two separate cards when your family accounting is unified is that these graphs are essentially useless because they only show part of the picture.

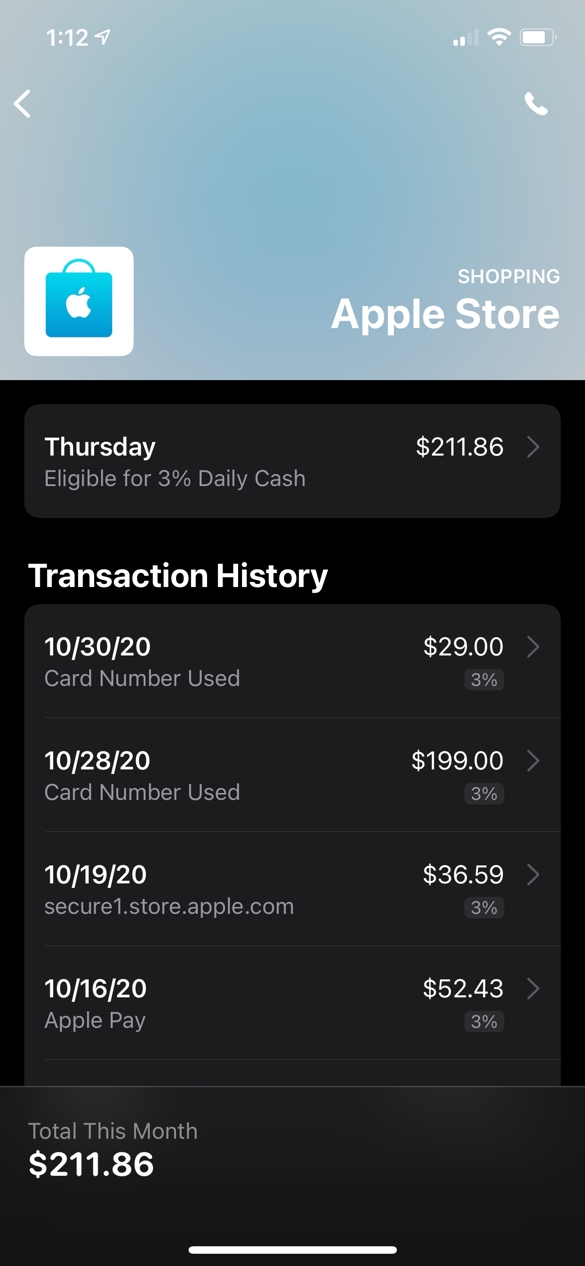

Drilling into a particular merchant will show you all of the transactions for that merchant. If I want to see everything I’ve bought at Apple it’s extremely easy to pull up the list. This is nice compared to most services that show barely legible names for charges which are often varied and irregular. In those other services its hard to pull up everything you’ve spent at a specific place. In addition to the date and amount you can also see what percentage you got cash back from each transaction. Everything you buy at Apple earns 3%, if you used Apple Pay with your Apple Card at a non Apple retailer it’s 2% and everything else is 1%. This is crazy simple to wrap your head around compared to other credit cards, and there are no monthly promos to sign up for to unlock different percentages. The best part about Apple’s cash back, though, is that you don’t have to wait until the end of the billing cycle to get that benefit. As soon as a charge clears you receive your cash back award in your Apple Cash account.

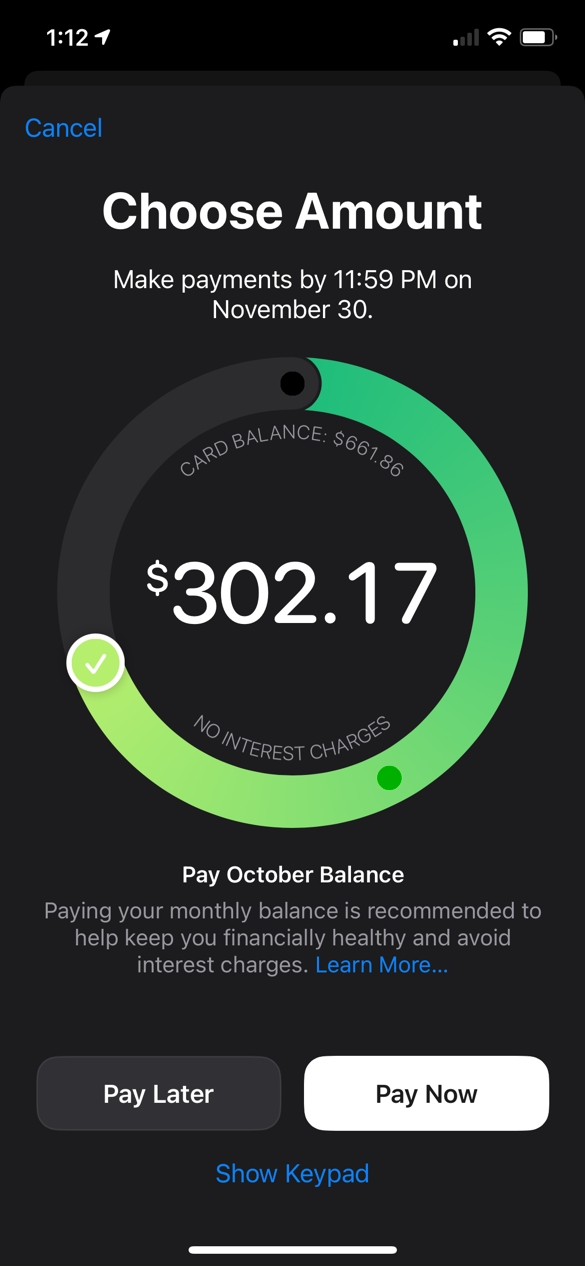

If you want to make a payment on your Apple Card you can set it up to happen automatically or do it manually from within the Wallet app on your iPhone. If you want to pay manually you’re presented with a pretty cool circular image of the amount you can pay. You can drag the control dot around the circle to change how much you’re going to pay. The circle visualizes exactly what your balance is and what needs to be paid to avoid interest. The first time you make a payment you can choose to use the debit card that’s paired to your Apple Cash. This is novel because when you pay your card it’s instant, as opposed to online bill bay using an ETF withdrawal from your checking account that takes days to clear. The immediacy of this payment is a really nice improvement to the credit card payment experience.

My biggest beef with the Apple Card is the separate accounts for spouses. Ideally I could have partially worked around this using my preferred budgeting service Mint, however the Apple Card is not supported by Mint. That actually complicates things further because it means a chunk of my spending is not visible in my overall financial picture. This is really the heart of the matter for me; the Apple Card sits on an island and does not fit in with the rest of your financial picture. This is not unlike Apple’s disjointed family experience with Photos. For whatever reason Apple seems to assume that spouses and family only share certain stuff, like iCloud storage and Apps purchased, but not Credit Card accounts and certainly not Photos (that’s a rant waiting to happen…). Apple needs to get with the program on the Photos front and on the joint Credit Card accounts, too.

I suspect that Mint will eventually sort out the issues with Apple Card and support it. However, until it does I’m only using it for purchases at Apple. Ideally I’d like to make this my primary credit card, but I just can’t do that until either my wife’s and my cards are somehow combined or Mint starts supporting it.

Now here’s the thing: the Apple Card is actually perfect for a lot of people. For starters, if you’re solo or just do your banking solo than my primary quip about separate accounts is a moot point for you. If that’s you then the next thing I would look at is if you have any reason to use another credit card alongside the Apple Card. If you don’t have that need and you can really consolidate to a single credit card (as most people should) then the Apple Card is a great one to do so with. If you pay a lot of bills with a debit card or checking account directly that’s the final consideration here, because you’ll be struggling to identify how much you’ve spent at a given time across accounts that don’t aggregate yet in services like Mint. The big takeaway here is if you can really go all in on the Apple Card, do it. If you can’t, it might be better to wait, or just use it for your annual (or semi-annual) iPhone upgrade.